Ensemble Deep Learning Strategy for Handling Imbalanced Credit Card Fraud Data

Strategi Pembelajaran Mendalam Ensemble untuk Menangani Data Penipuan Kartu Kredit yang Tidak Seimbang

DOI:

https://doi.org/10.21070/joincs.v8i2.1670Keywords:

Credit card, Ensemble, dataset, deeplearning, fraud dataAbstract

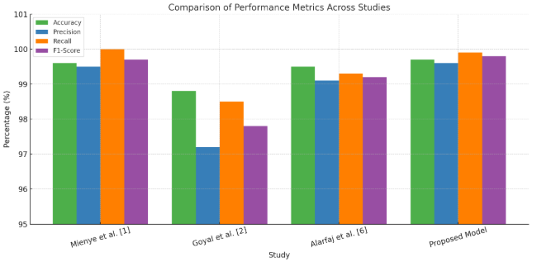

Credit card fraud remains a major challenge in the financial sector due to its dynamic nature and highly imbalanced transaction data. This study presents a robust deep ensemble learning approach that integrates spatial, sequential, and temporal learning capabilities. A series of preprocessing steps were applied, including feature normalization, class-label separation, and class rebalancing using SMOTE. The model architecture combines convolutional, recurrent, and long short-term memory layers to capture diverse fraud patterns. These components are merged and passed through dense and dropout layers for optimal binary classification. The datasets used are generated from real-world credit card transactions, ensuring practical relevance. On the test set, the proposed model achieved 99.7% accuracy, 99.6% precision, 99.9% recall, and 99.8% F1-score. The training and validation loss curves showed smooth convergence without any overfitting, confirming model stability. To ensure reliability, 3-fold stratified cross-validation was performed on the balanced dataset. The average metrics across folds included 99.76% accuracy, 99.70% precision, 99.85% recall, and 99.77% F1-score. These results underscore the generalization capability and consistent prediction performance of the model. Comparative analysis showed that the group model outperformed individual CNN, RNN, and LSTM architectures. The hybrid strategy benefits from the spatial extraction of CNN, sequence modeling of RNN, and memory retention of LSTM. By integrating these strengths, the model effectively detects subtle and complex fraud patterns. This approach provides a scalable and reliable solution for real-time fraud detection in imbalanced credit card datasets.References

Nilson Report. (2023). Global Fraud Loss Projections.

2. A. Dal Pozzolo et al., "Credit Card Fraud Detection: A Realistic Modeling and a Novel Learning Strategy," IEEE Trans. Neural Netw. Learn. Syst., 2015.

3. N. Chawla et al., "SMOTE: Synthetic Minority Over-sampling Technique," J. Artif. Intell. Res., 2002.

4. Y. LeCun, Y. Bengio, and G. Hinton, "Deep learning," Nature, vol. 521, no. 7553, pp. 436–444, 2015.

5. A. Dal Pozzolo, O. Caelen, R. Johnson, and G. Bontempi, “Credit Card Fraud Detection Dataset,” Kaggle, 2015. [Online]. Available: https://www.kaggle.com/mlg-ulb/creditcardfraud.

6. Khalid, S. E., Ahmed, A. R., & Rahman, F. (2024). ML ensemble with sampling for fraud detection. Applied AI.

7. Chagahi, M. H., Delfan, N., Dashtaki, S. M., Moshiri, B., & Piran, M. J. (2024). An innovative attention-based ensemble system for credit card fraud detection. arXiv.

8. Talukder, M. A., Hossen, R., Uddin, M. A., Uddin, M. N., & Acharjee, U. K. (2024). Hybrid dependable ensemble machine learning model using IHT-LR and grid search. arXiv.

9. Korany, S. E., & Taha, M. (2023). Optimized deep learning approach for detecting fraudulent transactions. Information Journal.

10. Rzayeva, D., & Malekzadeh, S. (2022). A combination of deep neural networks and k-nearest neighbors for credit card fraud detection. arXiv.

11. Forough, J., & Momtazi, S. (2021). Ensemble of deep sequential models for credit card fraud detection. Applied Soft Computing, 99, 106883.

12. Upadhyay, N., et al. (2021). Credit card fraud detection using CNN and LSTM. Indonesian Journal of Electrical Engineering and Computer Science.

13. Habibpour, M., et al. (2021). Uncertainty aware credit card fraud detection using deep learning. arXiv.

14. Zhao, F., et al. (2023). Modern deep learning techniques for credit card fraud detection: A review (2019–2023). ResearchGate.

15. Chen, J., & Lai, X. (2021). Enhanced credit card fraud detection based on attention mechanism and LSTM deep model. Journal of Big Data, 8.

16. Rtaly, N., & Enneya, N. (2020). Enhanced credit card fraud detection based on SVM RFE & parameter optimization. Journal of Information Security and Applications, 55.

17. Ali, M., et al. (2024). Credit card fraud detection based on GAN GRU hybrid model. MDPI Technologies, 12(10), 186.

18. Nguyen, T., Cheng, D., & Deepika, S. (2020). Deep convolutional neural network for credit card fraud detection. Systematic Review.

19. Benchaji, I., et al. (2021). Credit card fraud detection model based on attention enhanced LSTM. Journal of Advances in Information Technology.

20. Mienye, I. D., Sun, Y., & Selic, B. (2023). A robust ensemble deep learning model based on GRU, LSTM, and MLP for imbalanced credit card fraud detection. Computers, Materials & Continua, 74(2), 3017–3032. https://doi.org/10.32604/cmc.2023.041052Taha, A. A., & Malebary, S. J. (2020). Optimized LightGBM for credit card fraud detection. IEEE Access, 8, 25579–25587.

21. Goyal, D., Goyal, S., & Arora, A. (2023). Hybrid deep learning ensemble model for credit card fraud detection. Materials Today: Proceedings. https://doi.org/10.1016/j.matpr.2023.05.160Yanto, Y., et al. (2024). Best machine learning model for fraud detection: SLR (2014–2024). Dimensions.ai.

22. Alarfaj, A. A., Alshamrani, H. A., & Khan, R. A. (2024). A hybrid machine learning approach for credit card fraud detection using imbalanced data. Journal of King Saud University - Computer and Information Sciences. https://doi.org/10.1016/j.jksuci.2024.101851

Downloads

Published

How to Cite

License

Copyright (c) 2025 Zainab Hassan Mohammed, Farah Hatem Khorsheed, Ghazwan Jabbar Ahmed

This work is licensed under a Creative Commons Attribution 4.0 International License.